Investment Objective

Unlock the Power of Growing Dividend Income.

The fund seeks dividend income and long-term capital appreciation.

Overview

The strategy’s primary goal is to generate a growing stream of income through investments in a diversified portfolio of equities. We seek companies with a stable, high, and growing dividend.

- Seeks a diversified portfolio of high-quality businesses that consistently increase dividends

- Dividends and dividend reinvesting have made up a significant portion of market returns over time

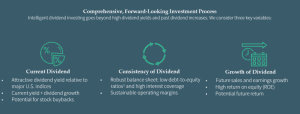

- Comprehensive, forward-looking approach to dividends

- Seeks to provide current income today that can grow into the future

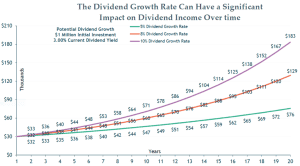

Source: Berkshire Asset Management. Hypothetical chart is for illustrative purposes only. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time

The Power of Compounding Dividends

Dividends and dividend reinvesting have made up a significant portion of market returns over time

A Forward-Looking Approach to Dividends

Simple screens of historical data may fail to capture the full dividend growth opportunity set

High-quality, dividend-paying portfolio

Seeks to provide current income today that can grow into the future

06/29/2023

Equity

USD $8.9 mm as of 02/26/2026

USD

-

Berkshire Asset Management, LLC, was appointed to manage the fund on 06/29/2023. As the performance shown includes that of previous managers, we have added a chart to show performance of the underlying strategy, which we believe is more relevant to investors.

- Since Strategy Implementation

- Cumulative

- Annualized

- Calendar Year

- Growth of Investment

* The hypothetical $10,000 investment at fund inception includes changes due to share price and reinvestment of dividends and capital gains. The chart does not imply future performance. Indexes are unmanaged, do not incur fees, expenses or taxes, and cannot be invested in directly.

Performance quoted does not include a deduction for taxes that a shareholder would pay on the redemption of fund shares.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. Short term performance is not a good indication of the fund’s future performance and should not be the sole basis for investing in the fund. Indexes are unmanaged, do not incur fees, and cannot be invested in directly. Returns less than one year are not annualized.

Risk & Return Metrics (1Y) as of 02/26/2026

Alpha 5.66

Sharpe Ratio 1.38

Information Ratio -0.41

Standard Deviation 7.46%

Tracking Error 0.08

Beta 0.48

Negative Months 3.00

Positive Months 9.00

Worst Month -2.88%

Best Month 3.74%

Upside Capture Ratio 0.49

Downside Capture Ratio -0.67

Maximum Drawdown -5.32%

Management Fee

0.00%

Performance Fee

0.00%

Max. Subscrition Fee

0.00%

Max Redemption Fee

0.00%

Minimum Investment . (USD)

$ 10,000

Document Type

Publication Date

Download

Disclosure:

The Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 800-960-0188 or visiting www.imgpfunds.com. Read it carefully before investing.

Berkshire Dividend Growth ETF Risks: Investing involves risk. Principal loss is possible.

Securities that pay dividends, as a group, may be out of favor with the market and underperform the overall equity market or stocks of companies that do not pay dividends. In addition, changes in the dividend policies of the companies held by the Fund or the capital resources available for such company’s dividend payments may adversely affect the Fund. Growth stocks are generally more sensitive to market movements than other types of stocks primarily because their prices are based heavily on the future expectations of the economy and the stock’s issuing company. The interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market.

The Fund is newly formed and has no operating history.

A commission may apply when buying or selling an ETF.

Index Definitions | Industry Terms and Definitions

The Berkshire Dividend Growth ETF is distributed by ALPS Distributors, Inc. LGE000224 exp. 1/31/2025

US

US