Are Small And Mid-Cap Equities Set To Shine?

The US equity market continues to exhibit a tale of two parts: the mega-cap driven S&P 500, propelled by AI enthusiasm and global reach, versus the more domestically oriented small- and medium-cap universes, represented by the S&P 600 Small Cap and S&P 400 Mid Cap indices.

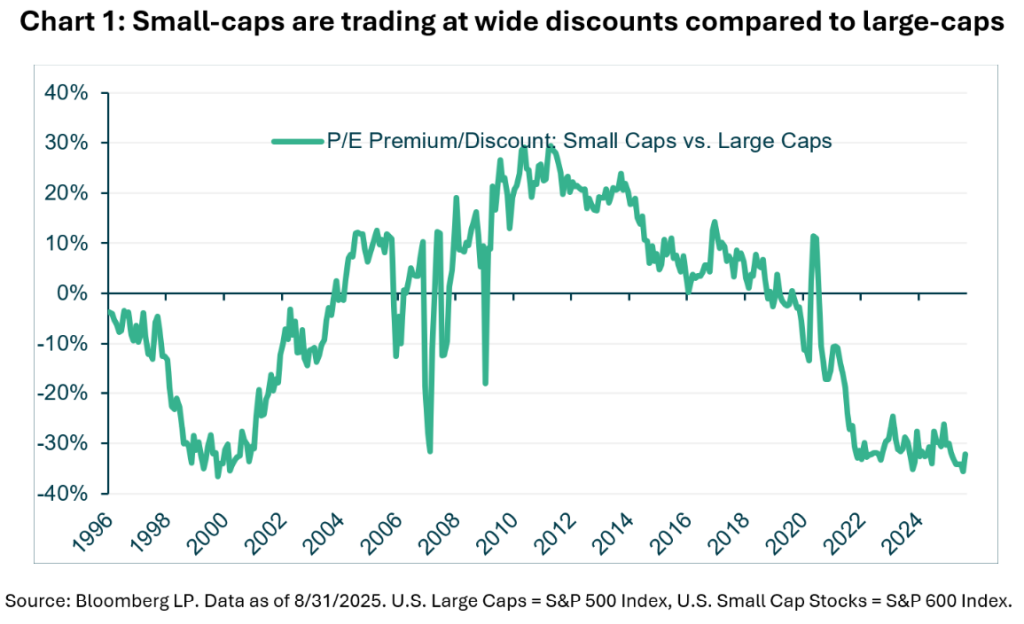

With market caps typically ranging from $850m to $5bn for small caps (S&P 600) and $5bn to $15bn for mid-caps (S&P 400), small and medium companies have traditionally offered investors higher growth prospects than their large-cap peers in return for taking on additional risk. But as chart 1 below illustrates, this relationship has not held in recent years as they have lagged behind large-cap companies, creating significant gaps in relative valuations and the potential future returns should these trends return to their long-term norms.

The attractiveness of small-caps is also amplified by several other factors, including their sensitivity to rate cuts from the US Federal Reserve, lower multiples relative to historical norms and large-cap peers, and recent positive performance that suggests a potential rebound. With monetary easing underway, we believe small- and mid-cap companies could be set to benefit.

Small- and mid-cap companies are more sensitive to interest rate fluctuations due to their reliance on debt financing. Unlike their large-cap peers, which often hold substantial cash reserves and have access to low-cost fixed-rate debt, smaller firms frequently carry floating-rate loans tied to benchmarks like the federal funds rate. This makes their interest expenses more volatile, squeezing margins when rates are hiked but unlocking significant relief when rates are cut.

The Fed’s move to resume monetary easing in September 2025 has already sparked optimism. Traders are now pricing in two additional 25-basis-point reductions by the end of 2025, with additional easing into 2026.

Valuation metrics underscore the potential bargain in small and mid-caps, which, as the chart above illustrates, are currently trading at discounts to both historical norms and large-cap behemoths. This disparity reflects investor caution amid economic uncertainty, but positions these segments for multiple expansion as rates fall.

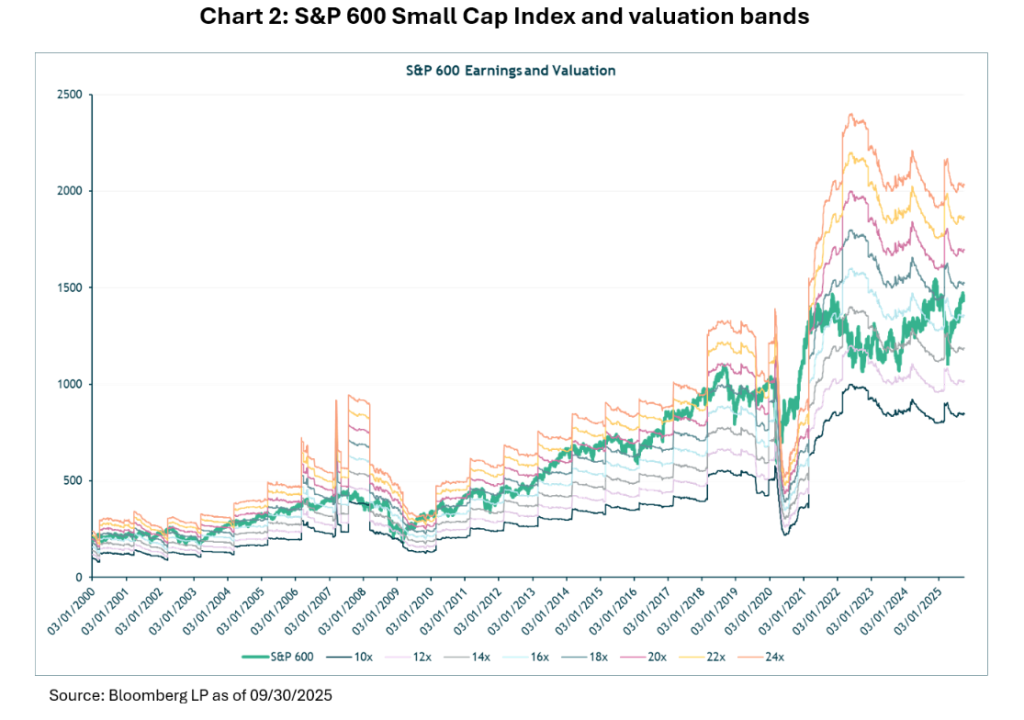

The S&P 600 Small Cap Index, which focuses on profitable small-cap firms, traded at a trailing P/E ratio of 15.9 as of 30 September 2025, slightly above its 10-year average of 14.5 but within one standard deviation (13.0-16.0). This compares favourably to its five-year average of 14.8, reflecting recovery from 2020’s earnings distortions. Chart 2 shows how the S&P 600 Small Index is trading near its long-term average, midway between extreme high and low valuations.

Meanwhile, the S&P 400 Mid Cap Index, with a trailing P/E around 16.5, sits below its 10-year average of 18.0, signalling undervaluation relative to its historical norm. Both indices are 15-25% below their late-1990s peaks, offering a margin of safety for investors anticipating economic stabilisation.

The valuation gap with large caps is striking. The S&P 500’s Price/Earnings ratio has climbed to 27.9 as of 30 September, a significant premium to its 25-year average of 18.6 and approaching dot-com bubble levels. In contrast, the S&P 600’s 15.7 P/E reflects a significant discount to the S&P 500.

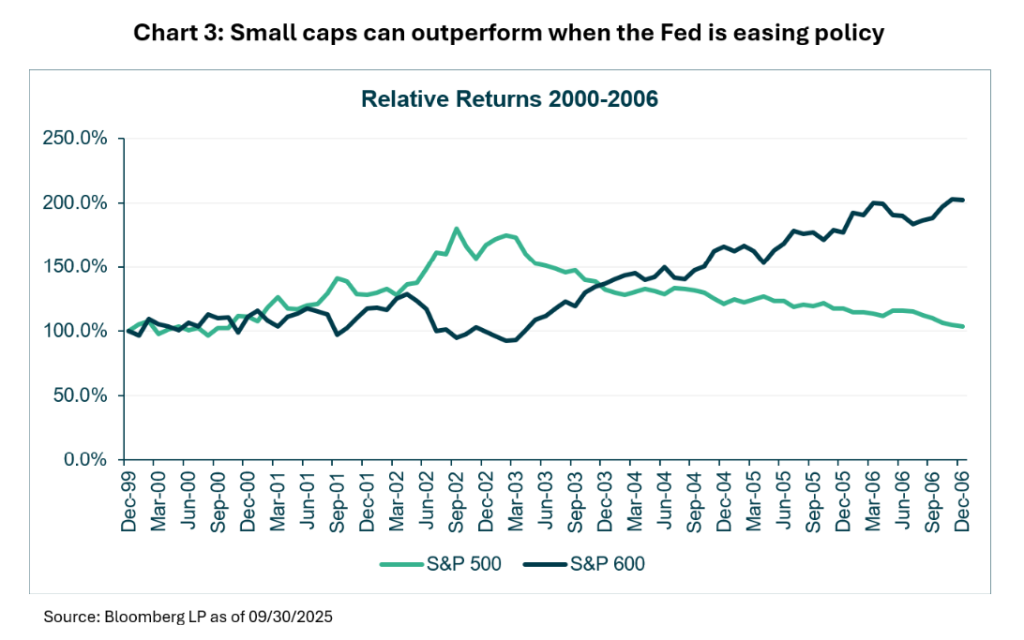

This gap, combined with expected earnings growth from rate cuts, mirrors the 2000-2006 period when small caps outperformed large caps by 99% amid Fed easing (as shown in chart 3).

The recent performance of small and mid-caps reflects their cyclical sensitivity but also hints at a turning tide, especially against historical benchmarks.

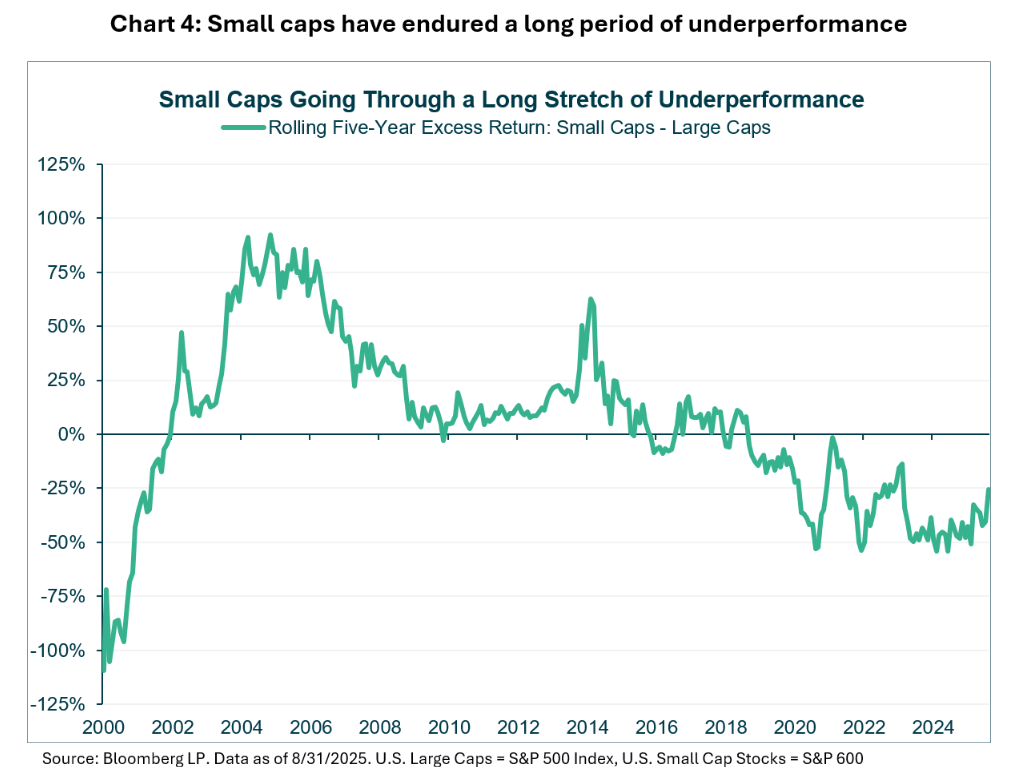

The S&P 600’s year-to-date net total return as of 30 September is approximately 4.2% in USD terms, following gains of 8.7% in 2024 and 16.1% in 2023. However, as chart 4 shows, smaller companies have significantly trailed their larger-cap peers for nearly two decades, a situation that has rarely persisted over longer time periods.

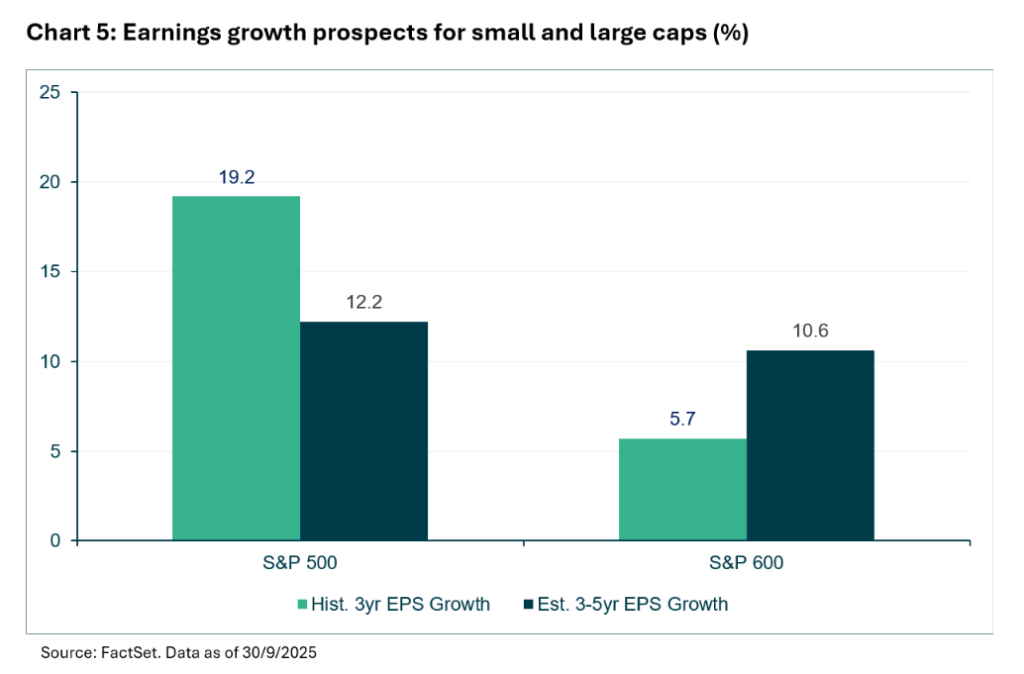

Smaller cap companies were hit hard during the Covid-19 pandemic, with the combination of profitability challenges and financial pressures resulting in a drop in earnings. By contrast, large-cap companies (helped by the mega-cap tech companies) produced EPS growth of just under 20% over the past three years (see chart 5).

These trends look set to reverse in the future, with S&P 600 earnings estimated to almost double over the next three to five years to just over 10%, in contrast to the S&P 500 which is predicted to normalise and fall to 12% growth. Given the large disparity in valuation between the two, and the Federal Reserve in easing mode, smaller cap companies could be set for a turnaround.

The iMGP US Small and Mid Company Growth Fund offers investors a strong option to access this market. Sub-advisors Polen Capital have appointed a new management team who brings with them a proven investment process and long track record. The team follow a fundamental, forward-looking process focused on identifying companies with key competitive advantages and positive business conditions. We feel the team’s dynamic investment process is particularly suited for today’s changing environment.

Disclaimer

This marketing document has been issued by iM Global Partner SAS a French company domiciled at 20 rue Treilhard, F-75008 Paris (France), supervised and authorized by the Autorité des Marchés Financiers under number 6925760 as a portfolio management company, for professional investors only. The content of this document has been approved for the purposes of Section 21 of the Financial Services and Markets Act 2000 (FSMA) for issue in the UK by iM Global Partner UK Ltd, which is authorised and regulated by the FCA (FRN: 927232). The collective investment scheme referred to in this document is a recognised scheme for the purposes of marketing into the UK pursuant to Section 271A (1) of FSMA. This is not a contractually binding document, or an information document required by law. It is not intended for distribution to or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, issue or use. Users are solely responsible for verifying that they are legally authorized to consult the information herein. Only the most recent version of the prospectus, the key information document (KID)/key investor information document (KIID), and the annual and, if any subsequent, half-yearly reports of the investment fund “iMGP” (hereinafter referred to as the iMGP’s “legal documentation”) should be considered as a basis for investment decisions. These documents as well as the summary of investors’ rights are available in English on the website, www.imgp.com/iMGP, or from the iMGP offices at 5 Allée Scheffer, L-2520 Luxembourg.

The information or data contained in the present document does not in any way constitute an offer or a recommendation or advice to buy or sell shares in the Fund’s units. Furthermore, any reference to a specific security in this document should not be construed as a recommendation or investment advice. They are intended solely to inform the investor as to past performance, and do not reflect the opinion of iMGP or any related companies as to future returns. The information, opinions and assessments contained in the present document shall apply at the time of publication and may be revoked or changed without prior notice. iMGP has not taken any measures to adapt to each individual investor who remains responsible for his own independent decisions. Moreover, investors are advised to consult their legal, financial or tax advisors before making any investment decisions. Tax treatment depends entirely on the financial situation of each investor and may be subject to change. It is recommended that investors obtain the appropriate expert advice before taking any investment decisions. This marketing document is in no way intended to replace the legal documentation and/or any information that investors obtain from their financial advisors. Investing puts your capital at risk: investing in equity securities may offer a higher rate of return than other investments. However, the risks associated with investments in equity securities may also be higher because the performance of equity securities depends upon factors that are difficult to predict. Historically, equity securities have provided greater long-term returns and have entailed greater short-term risks than other investment choices. More information on www .imgp.com.

The value of the units referred to may fluctuate and investors may not recoup all or part of their original investment. Investors should consult iMGP’s prospectus for further details on the risks involved. Past performance does not predict future returns. It is calculated in the unit currency and, where investments are made in a different currency, may also be affected by fluctuations in exchange rates. The performance data given does not include commissions or any fees linked to the subscription to and/or repurchase of shares. Returns are calculated net of fees in the reference currencies of specific sub-funds. They reflect the current fees, include management commissions and possibly also performance commissions deducted from the sub-funds. All returns are calculated from NAV to NAV with dividends reinvested. Unless otherwise stated, the performance of sub-funds is shown on a total return basis, including dividends or any other relevant distributions. All returns shown are gross of any tax deductions that could be applicable to an investor. It is possible that companies linked to iMGP and their executives, directors or personnel hold or have held stakes or positions in the securities listed in this document, or that they have traded or acted as market maker for these securities. Moreover, these entities or individuals may also have past or present ties with the executives of the companies issuing the abovementioned shares; furnish or have furnished financial or other services; or are or have been a director of the companies in question. Please note that any reference to an index is made for information purposes only. The performance of the Fund may differ from the performance of the index. None of the index provider data may be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices.

For further information, please refer to the most recent version of the “KID”/”KIID”.