Top-Down, Bottom-Up, Upside-Down: Rethinking Replication Risk

It has become common wisdom that factor-based replication is a top-down approach while risk premia strategies are bottom-up. Factor models, so the story goes, assume hedge fund returns can be explained by broad, observable exposures such as equities, rates, currencies, or commodities. Risk premia strategies, by contrast, are constructed from the bottom up, assembling portfolios of individual building blocks such as carry, momentum, or volatility selling.

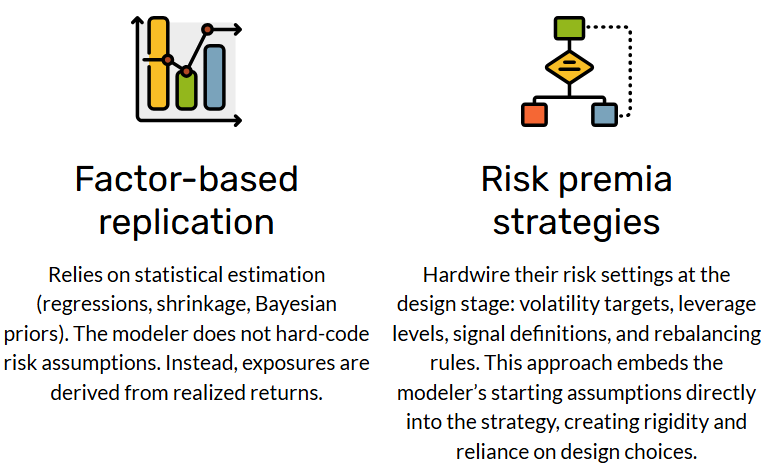

This classification is sensible when viewed through the lens of portfolio construction. But when we shift the focus to model risk, the picture reverses. Factor replication, far from being “top-down,” actually allows risk to flow upward from the data. Risk premia, meanwhile, is more prescriptive, embedding the designer’s risk views at the modeling stage.

For allocators, the conventional “top-down vs. bottom-up” framing obscures the real trade-off. The choice is not just about construction but about how much model discretion one is willing to accept.

Investors should therefore ask not only what approach best captures hedge fund returns, but also whose risk assumptions they are comfortable underwriting: the market’s (through realized exposures) or the modeler’s (through prescriptive design)?