Philippe Couvrecelle speaks to Daniel Dolan

In this insightful conversation, Philipp Couvrecelle, CEO & Founder of iM Global Partner, and Daniel Dolan, Founder of Dolan McEniry Capital Management, reflect on their successful five-and-a-half-year partnership built on mutual respect, professionalism, and shared values in active fixed income investment. They highlight their collaborative achievements across Europe and the US, emphasizing the strength of Dolan McEniry’s track record in the investment-grade bond market, particularly their disciplined approach to avoiding defaults and delivering value through careful credit selection. The discussion also explores the evolving interest rate environment and its implications for bond investors, positioning their strategy as highly attractive in today’s market. With over two decades of consistent performance, Dolan McEniry continues to stand out as a long-term value-driven corporate bond manager, reinforcing iM Global Partner’s commitment to aligning with top-tier, risk-conscious asset managers.

Roger McEniry on 25 years of achieving risk-adjusted returns

Roger McEniry emphasizes the disciplined and risk-aware approach Dolan McEniry takes within the high-yield bond market, highlighting a strategy that has consistently delivered strong performance over the long term. With over 25 years of proven results, the firm has achieved top-decile rankings in the core plus bond category across multiple time frames, including 1, 3, 5, 7, 10, 15, 20, and 25 years. Their success spans key metrics such as total returns, risk-adjusted returns, and excess returns, underscoring the effectiveness of their conservative, research-driven fixed income strategy in managing risk and generating value through market cycles.

How Dolan McEniry chooses US corporate bonds

Roger McEniry, a seasoned manager of U.S. corporate bond portfolios, shares his insights into a successful fixed income investment strategy. He explains the firm’s identity as a fixed income value investor, focused on identifying bonds that are both “cheap and safe.” Unlike high-risk, high-reward plays or ultra-safe but underperforming options, the strategy emphasizes a balance, targeting bonds in the crossover space between lower investment grade and higher-rated high yield. This approach allows the team to uncover strong value opportunities while managing downside risk. With a clear philosophy grounded in disciplined credit analysis and value investing principles, the firm consistently seeks to outperform benchmarks and deliver competitive returns in the often volatile corporate bond market.

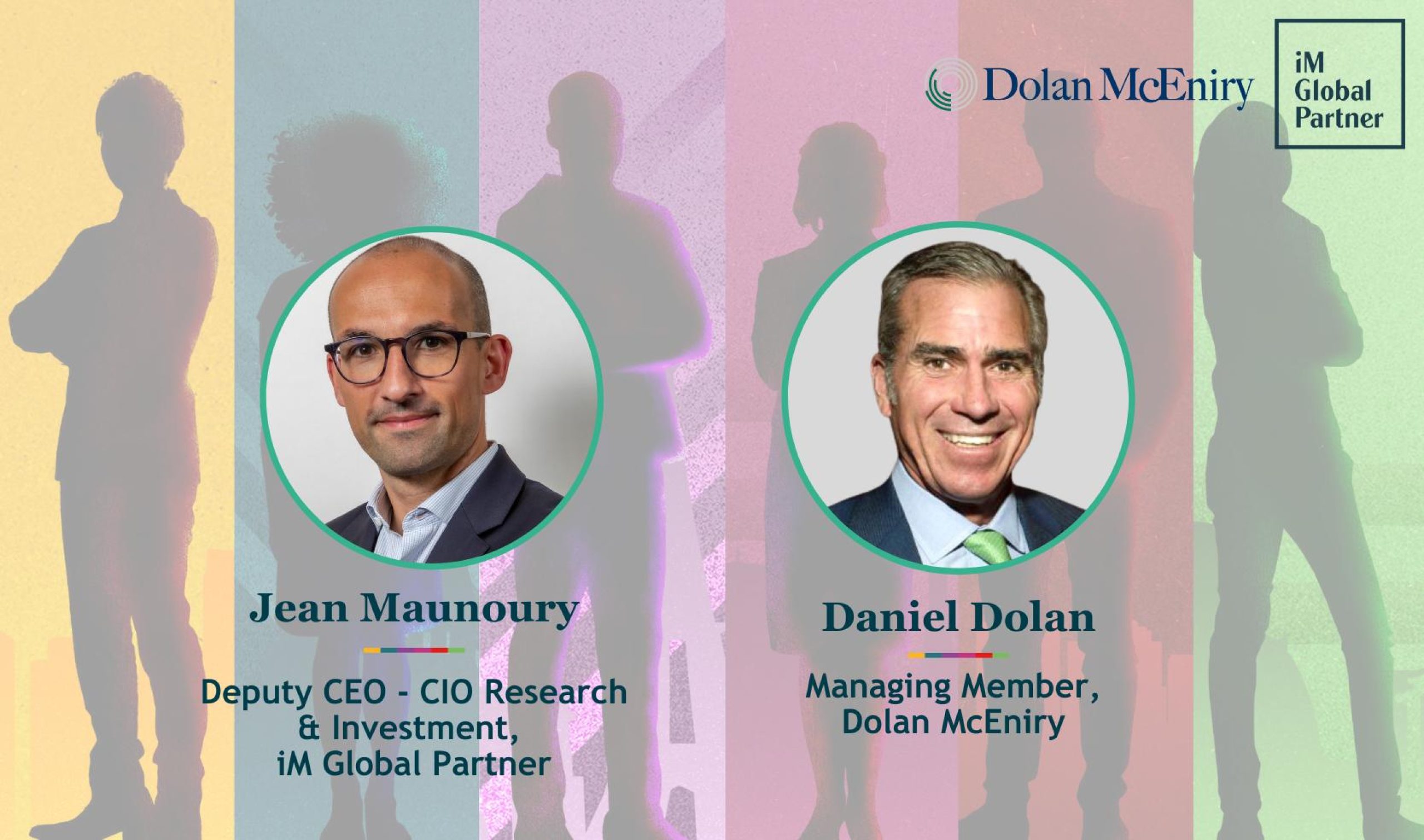

Daniel Dolan speaks to Jean Maunoury

Jean Maunoury, Deputy CEO & CIO Research & Investment at iM Global Partner, and Daniel Dolan, Founder and Managing Member of Dolan McEniry, discussing their long-standing partnership. Highlighting a commitment to active management, Daniel shares insights into his firm’s no-default record since 1997, attributing success to a disciplined, conservative approach focused on credit selection, avoiding derivatives, and maintaining a consistent four-year duration. Their strategy avoids financial sector bonds and instead emphasizes companies with strong cash flow, brand leadership, pricing power, and resilient fundamentals. Jean emphasizes how Daniel’s approach—free from duration bets and exposure to cyclical sectors, complements other fixed income managers. The discussion also covers 2023 fixed income expectations, with Daniel expressing optimism about current yields and portfolio positioning to take advantage of market volatility. The video underscores a differentiated, risk-averse investment philosophy designed to deliver consistent returns through all market cycles.